tax forgiveness credit pa

In Part D calculate the amount of your Tax Forgiveness. However we also received 40k in Social.

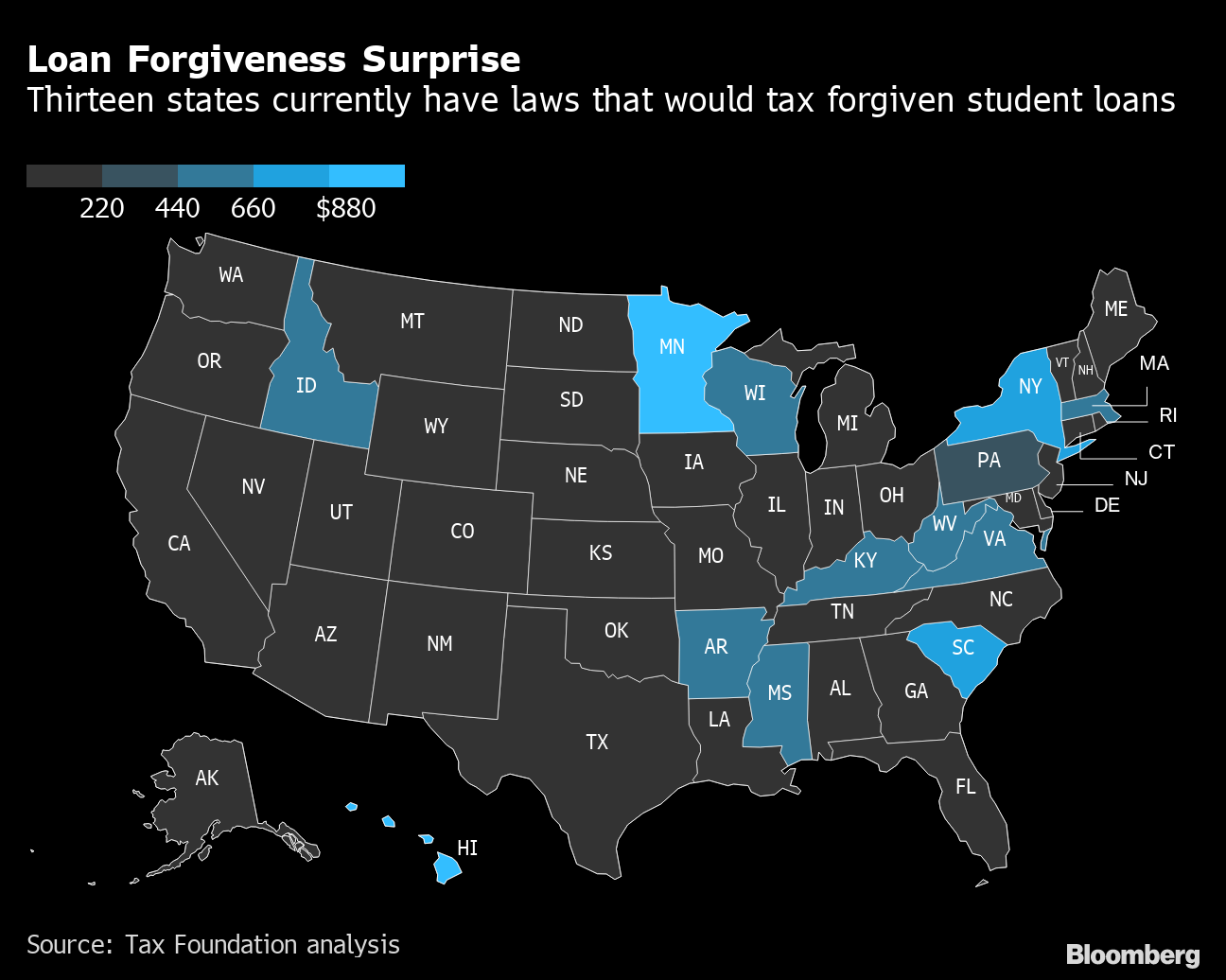

Student Loan Forgiveness Is Taxed In These 13 States Bloomberg

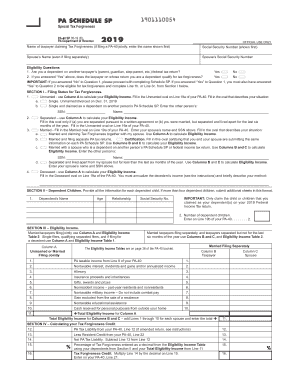

The Pennsylvania Tax Forgiveness credit is a credit against Pennsylvania tax which allows taxpayers that are eligible to reduce all or part of their tax liability to PA.

. The IRS debt forgiveness. The Pennsylvania Tax Forgiveness Credit is a credit that allows eligible taxpayers to reduce all or part of their tax liability to PA. The PA earned income was 9100.

The qualifications for the Tax Forgiveness Credit are as follows. What is tax forgiveness program. TurboTax indicates that we are eligible for the PA Special Tax Forgiveness Credit for 2021.

You andor your spouse are liable for Pennsylvania tax on your income. The IRS debt forgiveness. However any alimony received will be used to calculate your PA Tax Forgiveness credit Schedule SP.

Economy Education National Issues Press Release. August 31 2022. Eligibility income for Tax Forgiveness is different from taxable income.

Taxpayers who qualify for PAs Tax Forgiveness program may also qualify for the federal Earned Income Tax Credit program. Where do I enter this in the program. At the bottom of that column is the percentage of Tax Forgiveness for which you qualify.

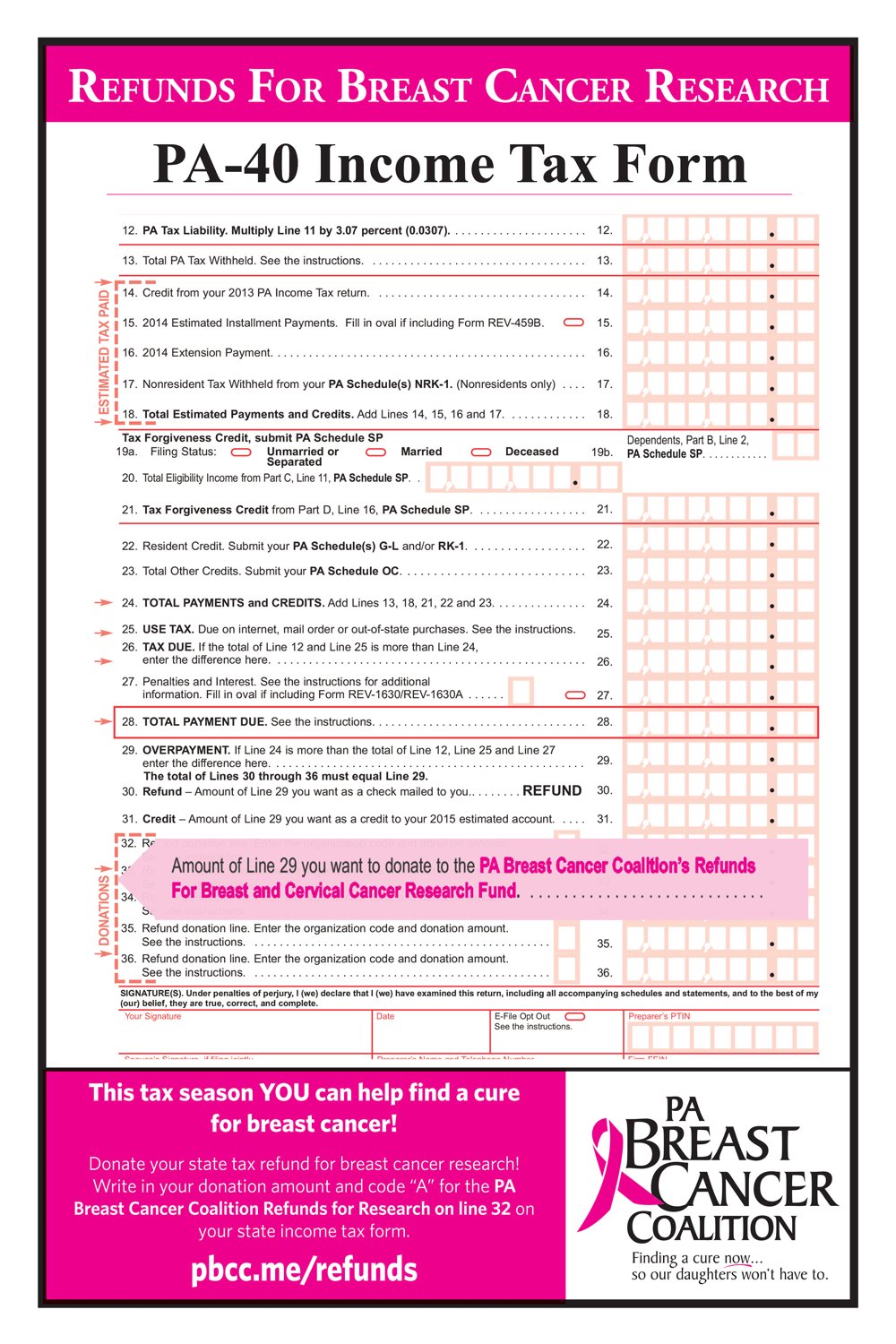

Record the your PA tax liability from Line 12 of your PA-40. Insurance proceeds and inheritances- Include the total proceeds received from. Taxpayers who qualify for PAs Tax Forgiveness program may also qualify for the federal Earned Income Tax Credit program.

The departments instructions allow dependent children to claim tax forgiveness because as the 1974 law identifies the intent of the General Assembly as described above. You are subject to Pennsylvania personal income tax. For more information visit the Internal Revenue Services at www.

Unmarried and Deceased Taxpayers. To receive tax forgiveness a. You can receive a Pennsylvania Tax Forgiveness Credit for up to 100 of your income tax on PA-40 Line 12.

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. What is a Pennsylvania tax forgiveness credit. ELIGIBILITY INCOME TABLE 1.

To claim this credit it is necessary that a taxpayer file a PA-40. Harrisburg PA With the personal income tax filing deadline approaching on May 17 2021 the Department of Revenue is reminding low-income. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax.

Record tax paid to other states or countries. S Web site at wwwirsgov or call the IRS toll-free 1-800-829. What is tax forgiveness program.

You can receive a Pennsylvania Tax Forgiveness Credit for up to 100 of your income tax on PA-40 Line 12. To enter this credit within. Eligibility income is greater because it includes many nontaxable forms of income such as interest on savings.

The Tax Forgiveness Program allows low income taxpayers to either reduce or eliminate their tax liability through tax forgiveness credits. If your Eligibility Income. Governor Tom Wolf today reminded Pennsylvanians that student loan borrowers who will receive up to.

Pennsylvania Pa Tax Forms H R Block

Pa Breast Cancer Coalition On Twitter Doing Your Taxes Donate Your State Income Tax Refund To Pa Breastcancer Research Find A Cure Now So Our Daughters Won T Have To Https T Co Mmw2gqer9y Twitter

Some Pennsylvanians May Be Missing Out On Pa Tax Refunds

Pa Dor Pa 40 Sp 2019 2022 Fill Out Tax Template Online

Irs Failed To Send Child Tax Credit To Millions Audit

The Cares Act And Pa Taxability

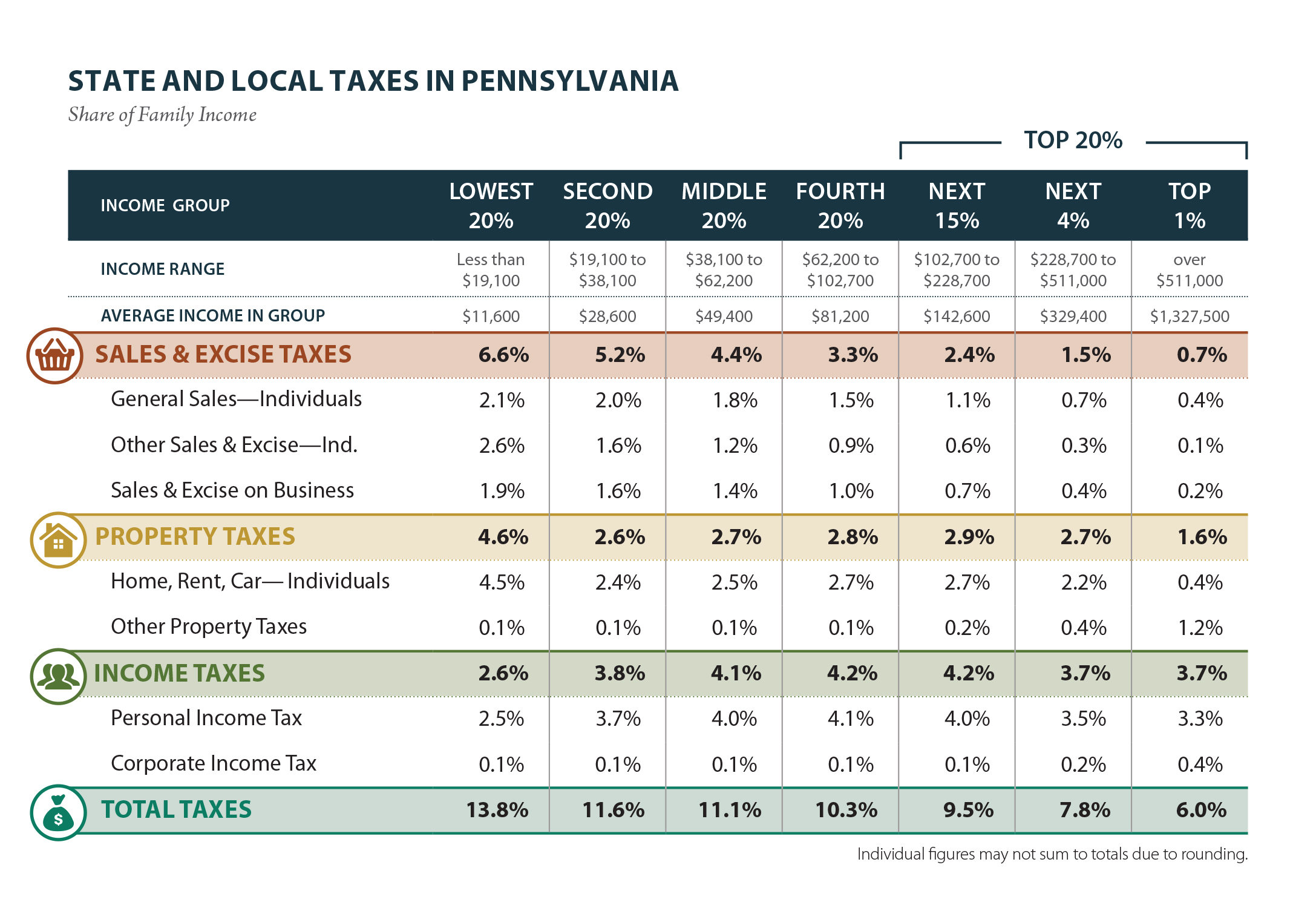

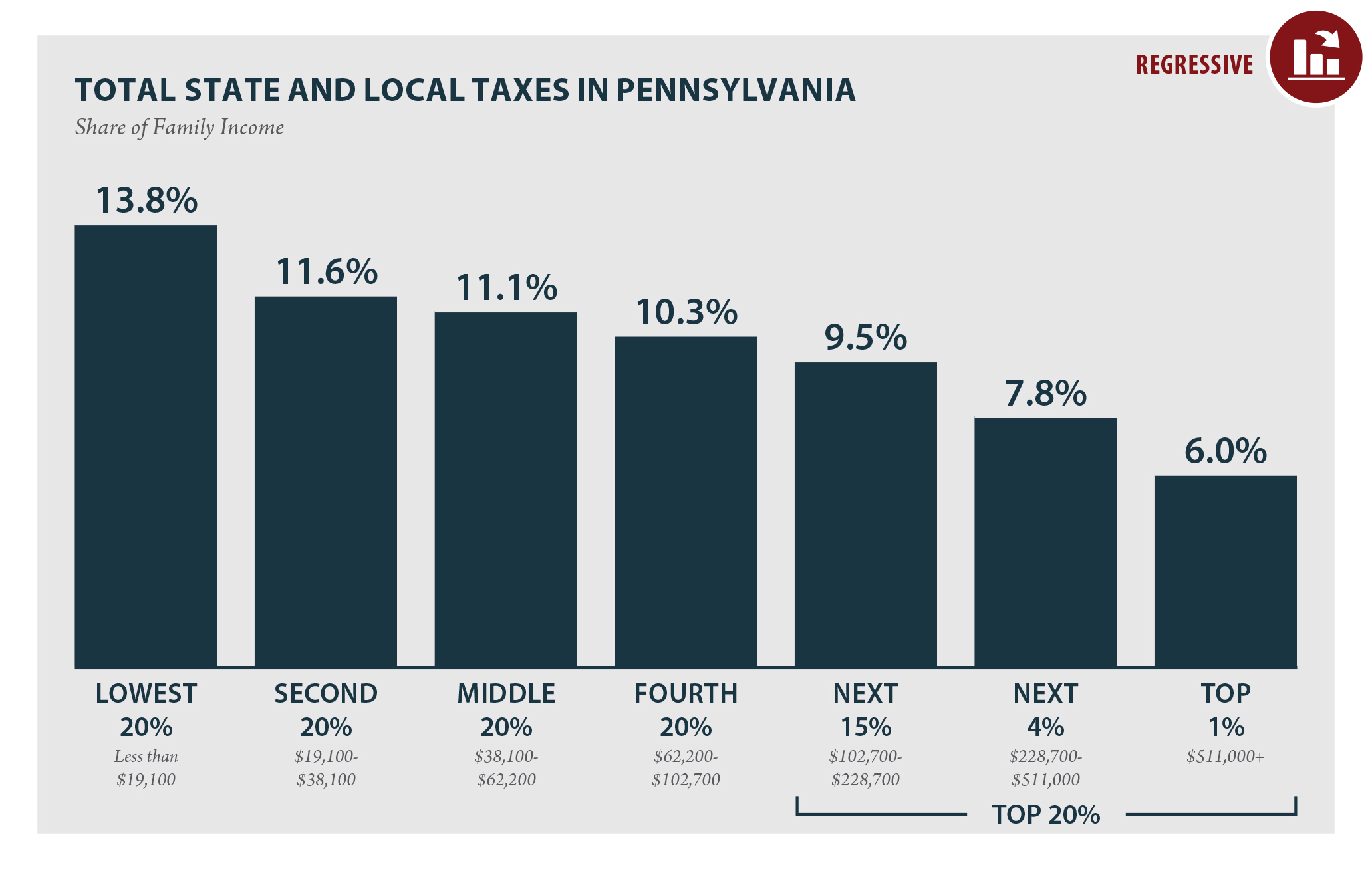

Pennsylvania Who Pays 6th Edition Itep

Pennsylvania Pols React To Biden S Student Loan Cancellation Plan City State Pennsylvania

Senator Lindsey M Williams Releases Statement On Federal Student Loan Forgiveness Tax Status Pennsylvania Senate Democrats

Pa Dept Of Revenue Encourages You To Use Electronic Filing Options To File State Income Taxes Fox43 Com

Pennsylvania Who Pays 6th Edition Itep

Pennsylvania Will Not Tax Student Debt Forgiveness Witf

Forgiven Student Loans Won T Be Taxed As Income By Pennsylvania Governor Says Cpa Practice Advisor

Make A Pa Earned Income Tax Credit Part Of The Budget

Filing A Pennsylvania State Tax Return Credit Karma

Pennsylvania Conforms To Tax Treatment Of Ppp Loans Grant Thornton

Are You Or Have You Been Employed In Public Service By The Government Or A Non Profit Organization The Pennsylvania Chiropractic Association